Kodiak Copper Corp (OTCQB:KDKCF) has shot up over 30% Year-to-date over the past year. The stock traded as high as $0.55 USD.

Kodiak stands out due to significant catalysts coming up this year: a resource estimate on its MPD project plus additional discovery potential of more copper-gold porphyry zones.

The company also differentiates from other junior mining companies as it is recognized and backed by some of the most influential names in the mining industry:

- Chris Taylor – Successfully sold Great Bear Resources for $1.8 billion. Now, he is focused on advancing Kodiak’s MPD project. [1]

- Claudia Tornquist – A former executive at Rio Tinto, one of the world’s largest mining companies. Her industry expertise provides strategic direction and credibility to Kodiak. [2]

- Teck Resources – A major player in the mining sector, Teck’s investment in Kodiak signals strong institutional confidence in its assets. To this date, they hold over 8% stake in Kodiak Copper Corp. [3]

SOURCE: StockScan.io (March 14, 2025)

Read More:

7 Reasons To Consider $KDKCF

Kodiak Copper Corp. investors should keep a close eye on it before its next milestones.

Here are 6 reasons why:

1. Low Market Capitalization Relative to Potential

With a low market cap of CAD $33 million, as Kodiak is still in the early stages of its exploration cycle on it’s 100-per-cent-owned MPD project in Southern British Columbia. [4] This relatively low market cap compared to its growing land holdings, favourable exploration results, and district-scale potential could offer a good upside if further success is realized.

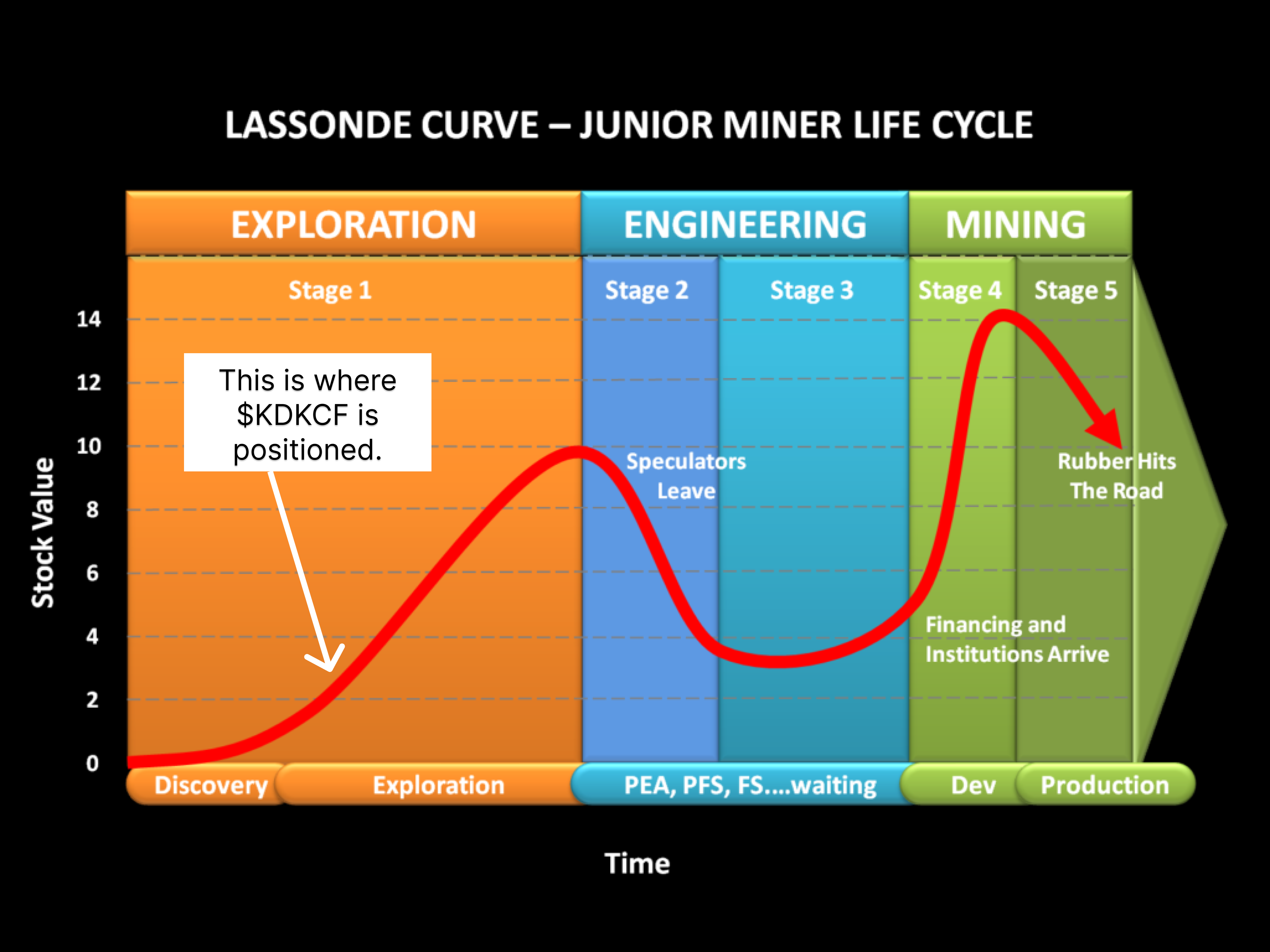

2. Upside Potential using the famous Lassonde Curve

Kodiak Copper Corp is in its discovery phase of the Lassonde Curve, showing the potential for high upside. Kodiak’s B.C. property is expansive, covering numerous known copper targets, which have the potential for discovery of new mineralization. [5] Discovery drill intercepts can have a tremendous impact on the share price of a junior exploration company. Recent examples include Amarc Resources Ltd’s AuRORA discovery (January 17, 2025) which saw an increase in Market Cap of +188 % to CDN $103.8 Million. [6] British Columbia (BC) is known for its copper deposits, and is the top producer of copper in Canada, hosting the top four copper producing mines [7]

DRILL DISCOVERIES HAVE IMPACT!

3. Track Record of Billion-Dollar Exits & Strong Team

Chris Taylor, founder of Kodiak Copper sold his last company to Kinross for an astonishing $1.8B. [8] As a structural and economic geologist with more than 20 years of experience with both mid-tier producers and junior exploration companies, he’s the man you want on your team. Chris has received numerous prestigious awards, including PDAC’S 2023 Bill Dennis Award, Northern Miner’s 2021 Mining Person of the Year, and Kitco’s 2021 Mining CEO of the Year. [9]

Claudia Tornquist, Kodiak’s CEO is the former General Manager at Rio Tinto working with Rio Tinto’s copper operations. She was also the former director of Kennady Diamonds, leading the $176M sale of the company to Mountain Province Diamonds. 10]

John Robins is an advisor and was a founding member of the Discovery Group, a leading dynamic group of exploration-focused companies with a remarkable track record of delivering shareholder appreciation. Kodiak is a high-profile company within the Discovery Group. John is the 2025 winner of the PDAC Viola R. MacMillian Award for lifetime leadership and significant contribution to the mining and exploration sector and numerous other awards. [11]

We believe there is no better team to lead the company to success.

Below is a January 2025 interview with Claudia and Chris discussing why Kodiak Copper stands out:

4. Analysts Sentiment (Richard Mills, TipRanks & Wallet Investors Consensus)

According to Richard (Rick) Mills from aheadoftheherd.com, there is no reasons why investors won’t do very well owning some $KDKCF (US) or $KDK shares in their portfolio. [12]

“We see no reason why investors won’t do very well for themselves owning KDK; in our opinion it’s an example, brought to you by AOTH, of what patient investors who know how to invest in this sector are paying attention to.” – Richard (Rick) Mills

5. Involvement of mining giant TECK

Teck’s involvement in Kodiak can be seen as a strong endorsement of the MPD project’s potential. They already control over 8% of Kodiak Copper following its 2020 strategic investment. [13]

The backing of this major industry leader suggests confidence in Kodiak’s assets and management, potentially leading to value appreciation as exploration progresses.

Kodiak Copper’s MPD copper-gold porphyry project is strategically located in southern British Columbia, within 40 kilometres distance of Teck’s Highland Valley Copper. [14]

Highland Valley Copper (HVC) is Teck’s flagship copper operation in British Columbia, and one of Canada’s largest open-pit copper mines.

6. Near-Term Upcoming Key Milestone & Benefits

Kodiak Copper Corp. is actively working on its inaugural National Instrument 43-101 compliant resource estimate for its flagship 100-per-cent-owned MPD project, with initial results anticipated in the first half of 2025. [15]

Potential Benefits to Shareholders:

- Enhanced Valuation: A NI 43-101 compliant resource estimate can provide a clearer picture of the project’s value, and a measure that investors and analysts use to value a project, and can potentially leading to a re-rating of Kodiak’s stock as the market gains a better understanding of MPD’s resource base.

- Increased Investment Appeal: A well-defined resource can attract interest from institutional investors and major mining companies, possibly leading to strategic partnerships or acquisition offers, thereby increasing shareholder value. Major mining companies (Freeport-McMoRan, Newmont, Xstrata Canada Corporation, Boliden Group, and KGHM Polska Miedź S.A) are active joint venture exploration and/or operational partners throughout British Columbia.

- Strategic Advancements: The resource estimate will guide future exploration and development strategies, enabling more efficient allocation of capital and resources, which can enhance project economics and, in turn, benefit shareholders. The resource estimate is a significant milestone for Kodiak Copper, with the potential to substantially enhance shareholder value through improved project valuation, increased investment interest, and strategic development planning.

7. Implementation of AI in Exploration

Kodiak Copper distinguishes itself in mineral exploration by integrating advanced artificial intelligence (AI) into its exploration processes, particularly at its MPD project.

In March 2024, the company partnered with VRIFY to utilize their AI mineral targeting software. [16] This innovative approach involves analyzing extensive geological data using deep learning and computer vision techniques to predict areas with a high probability of mineralization.

This dynamic integration of AI allows for more real-time and adaptable exploration strategies, setting Kodiak apart from many traditional exploration companies.

This has the potential to accelerate drill targeting, enhance efficiency thereby reducing exploration costs and increasing the likelihood of discovery success.

This positions the company at the forefront of modern mineral exploration methodologies, differentiating it from peers that rely solely on conventional techniques.

Key Takeaways:

- Kodiak Copper (KDK.V) has signigicant upside due to its low market cap, pending NI 43-101 resource estimate, and promising new copper porphyry discovery potential. Any good news can cause a significant increase in the share price.

- Exploration Success – In addition, through systematic drill campaigns since 2019 (over 85,000 metres completed) Kodiak has a track record of outlining multiple substantial zones of mineralization and adding new targets through programs of geochemistry, geophysics, and AI mineral targeting software. Recent successes include the Company’s maiden drill hole on the Adit Zone (Sep. 10, 2024) which intersected 357 metres 0.43 % Cu. Kodiak has expanded the MPD property from 78.5 sq-km in 2020 to current district-size of 338 sq-km.

If the goal is short-term profits, key factors to consider include:

- Stock Price Volatility – Smaller companies with exploration success often have sharp price movements.

- Near-Term Catalysts – Upcoming drill results, resource announcements, feasibility studies, or mine development can drive price spikes.

- Liquidity & Volume – Stocks with some trading volume are easier to buy and sell quickly.

Market Cap vs. Drill Results – A company with strong results and a low valuation has more room for rapid price appreciation. The recent success of Amarc, and positive market reaction has investors searching for a well financed and skilled management junior company poised to make the next significant copper porphyry discovery.

Orbiton Ticker Buttons

References:

- Kodiak Copper Investor Presentation

- Rio Tinto News

- Teck Resources News

- TSX Venture Exchange Listings

- The Lassonde Curve Theory

- Amarc Resources Ltd News

- Global Data Copper Report

- Kinross Gold News and Investors

- PDAC Awards

- Rio Tinto Website

- PDAC Viola R. MacMillian Award

- Ahead of the Herd – Richard Mills

- Teck Resources Investor Relations

- Highland Valley Copper – Teck

- SEDAR+

- VRIFY AI Exploration

Disclaimer:

Copyright 2025 by Connect 4 Marketing, a Quebec Corporation. For more information, please contact [email protected] This is NOT an official website of Questrade, Interactive Broker, TD Ameritrade, Fidelity, Charles Schwab or Ortbiton Financial but the official website of investorstockpicks.com

To more fully understand any subscription, website, application, product, or other service (“Services”) including stocksbychatgpt.com, owned or operated by Connect 4 Marketing (together with its affiliates, owners, and control persons, the “Publisher”), please carefully read the disclosure below.

This is an issuer-paid advertisement. Kodiak Copper Corp. has paid Publisher CAD $14,500 in cash for marketing services, including communicating information about the Company to the Public. This advertorial (“advertisement” or “Advertorial”) is part of those issuer-paid marketing services. The contract with Kodiak Copper Corp. was effective on January 28, 2025 and continues until February 28, 2025 OR when advertising budget is exhausted (the “Term”), unless terminated by written notice of either party prior to the end of the Term or extended. As a result of this advertisement and other marketing efforts, Publisher may also collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, Publisher holds no securities of the Company and does not intend to purchase any securities during the Term. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of the Company, increased trading volume, and possibly an increased share price, which may or may not be temporary and could decrease once the marketing services have ended.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own zero shares of (KDKCF). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Connect 4 Marketing Ltd. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY

Not Investment AdviceThis advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Publisher cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of this Company or any company’s financial position. This advertisement or any statements made in it are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the Company that is the subject of the Advertorial or any other companies mentioned in this Advertorial, nor should they be construed as a personalized recommendation to buy, sell, or hold any position in any security mentioned in this Advertorial or any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED

Any individual who chooses to invest in the securities of the Company profiled in the Advertorial or any securities of the companies mentioned in this advertisement should do so with caution. Although this advertisement focuses on the positive features of the Company profiled and its securities, you must keep in mind that investing or transacting in these or any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Not an Investment Advisor or Registered Broker

Neither Publisher nor any of their owners, employees, or independent contractors is currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS

Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Publisher does not undertake an obligation to update forward-looking statements in light of new information or future events.

TRADEMARKS

All trademarks used in this advertisement are the property of their respective trademark holders, and no endorsement by such owners of the contents of the advertisement is made or implied.

Connect 4 Marketing Ltd. and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party.” The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation.”

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Connect 4 Marketing Ltd., its managers, employees, affiliates, and assigns (collectively the “Publisher”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

To the maximum extent permitted by law, the Company disclaims all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations provided herein prove to be inaccurate, incomplete, or unreliable, or result in any investment or other losses.

Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research.

2 Comments

When does Kodiak Copper expect to have their resource out? Been waiting for this.

Looks like the $KDK stock is already up 20% in Canada, anyone know why?