The shift toward a sustainable energy future is facing challenges: there is a scarcity of copper, which is hindering global electrification goals amid increasing demand for the metal.

While most sectors are down in the U.S. due to increasing tariffs and uncertainty, mining companies are holding well.

Investors are showing interest in copper exploration mining companies that have undiscovered deposits.

Notably a lesser-known Canadian company catching the attention of industry experts.

Billionaire Investors are Starting to Amass Copper Mining Assets

Billionaires like Bill Gates and Jeff Besos recently invested heavily into copper projects.

Big investment firms such as BlackRock and Fidelity have been actively increasing their stakes in copper mining stocks as a sign of heightened interest in this industry sector.

Commodity speculator Lobo Tigre also mentioned copper as the commodity with the biggest upside going into 2025. He was right about uranium in 2023, and gold in 2025…

While eyes are turned to those big names, we’re eyeing Kodiak Copper Corp. ($KDKCF) as an undervalued stock.

Kodiak was founded by Chris Taylor, who previously sold his mining company for $1.8 billion dollars, making many shareholders happy. (scroll down to learn more on $KDKCF)

The Overlooked Shortage of Copper that Goes Unnoticed by the Public

Investors appear to be keen on AI related stocks. There’s an opportunity brewing in the copper market which could bring significant profits to early birds.

The International Energy Agency has voiced concerns about the need to double copper production within the decade. Reaching this goal appears challenging given the current mining capacities in place.

That’s why savvy investors in the natural resource sector are now eyeing out Kodiak Copper (TSX-V: KDK).

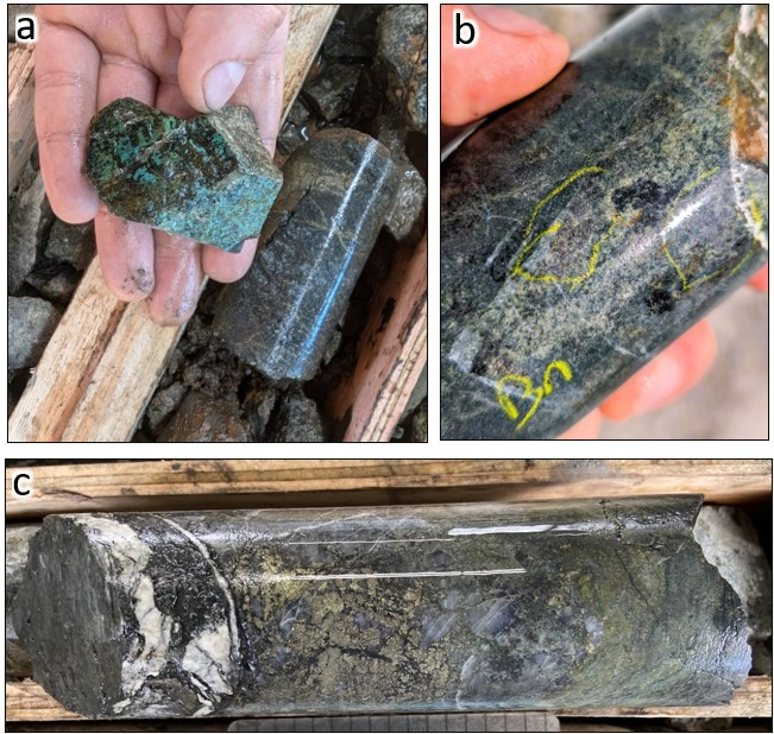

Kodiak has already found copper mineralized zones on its MPD project located in the Quesnel Terrane region of British Columbia’s mineral area.

Prominent mining companies such as Teck Resources, Hudbay Minerals Inc. and Centerra Gold operate in the area.

The Overlooked Shortage of Copper that Goes Unnoticed by the Public

Kodiak has identified seven different zones with promising mineral resource potential s during their continuous drilling activities.

Future drilling will continue to target for higher grade copper mineralization at surface using traditional methods (geophysical surveys and soil sampling) plus cutting edge AI programs to find more promising areas.

Results to date are impressive. They represent the kind of discoveries that grab the interest of mining companies looking for potential investment opportunities. Kodiak has proven their technical expertise through the years and have already attracted Teck Resources as a strategic investor in the company.

Copper prices are projected to rise from the rate of $2 per kilogram to $3 per kilogram by 2026. (Source: https://capital.com/copper-price-forecast)

The Possible Game-Changing Factor That Could Lead to a Surge in Kodiak’s Stocks

(Picture of Kodiak Copper Corps’s CEO and past Rio Tinto executive Claudia Tornquist)

The company recently announced an exciting milestone which should happen in the first half of 2025. Their is currently being completed and Part 1 is expected to be completed by the first half of 2025, in just a couple of months from today (Part 2 by the end of the year).

Investors are now starting to comprehend the scale and importance of Kodiak’s copper findings—a realization that insiders had already understood in advance.

With the CEO (Claudia Tornquist) owning 1.9M shares and the founder (Chris Taylor) of owning 1.26M shares, it shows their heavy involvement in the Company.

Kodiak Copper (KDKCF) currently trades in the $0.26-0.34 USD range with a modest market capitalization between $20-25 million USD. This valuation appears significantly underpriced when compared to its peers in the copper exploration space, creating what could be a compelling investment opportunity.

Every major company started somewhere…

Consider Freeport-McMoRan (FCX), a major producer trading around $40-50 USD with a market cap exceeding $60 billion. While FCX is at production stage, its growth story is instructive – the stock surged from approximately $5 in 2016 to $45 in 2021, representing an 800% increase as copper markets strengthened and their projects advanced.

More directly comparable is Amarc Resources Ltd. (TSXV: AHR; OTCQB: AXREF) who experienced a 165% stock surge in only 1 day in January 2025.This followed the announcement of the AuRORA deposit discovery, a high-grade porphyry copper-gold-silver system located within its JOY project in British Columbia, Canada…

Kodiak Copper: A Discount Stock

The valuation opportunity becomes apparent when examining metrics like enterprise value per pound of copper resource, where Kodiak currently trades at a substantial discount compared to peers.

Companies with projects of similar size and potential but have resource estimates often command valuations 3-5 times higher than Kodiak’s current market cap.

This substantial valuation discrepancy highlights why Kodiak Copper has a big potential growth appreciation as it advances its MPD project. The pattern is clear across the sector: when junior miners achieve significant drilling results or upgrade their resource estimates, the market frequently revalues these companies rapidly to align with peer valuations. Kodiak’s current price point provides considerable upside potential if it follows the growth trajectory demonstrated by its more advanced competitors.

With copper prices projected to remain strong due to increasing demand from green energy infrastructure and electric vehicles, companies with promising copper projects like Kodiak could see substantial valuation increases as they progress through development milestones.

By the second quarter of 2025, Kodiak also expects to announce the outcomes of their metallurgical tests. With copper prices on the rise because of limited supply, these catalysts could result in substantial profit increases for early investors.

Setting up Kodiak for Expansion by Leveraging Benefits

Kodiak Copper location also offers substantial benefits considering their project is not remote:

• Located in the mining region of British Columbia with year-round accessibility

• Proximity to infrastructure such as roads and power supply locations

• Chris Taylor and Claudia Tornquist are part of a group of respected figures in the industry

Christopher Taylor, M.Sc. (Chairman): Renowned exploration geologist who founded and led Great Bear Resources to a $1.8 billion acquisition by Kinross Gold. His expertise in copper porphyry systems and track record of creating shareholder value (recognized through multiple industry awards) brings discovery potential to Kodiak’s projects.

Claudia Tornquist, M.Eng, MBA (President/CEO): Former Rio Tinto copper executive and Sandstorm Gold EVP with proven M&A success, including chairing Kennady Diamonds’ $176 million sale. Claudia’s corporate background with M&A and strategic business expertise will be an asset that most exploration companies do not as Kodiak advances towards significant valuation milestones.

Together, they offer the ideal combination of geological expertise to make discoveries and business acumen to maximize shareholder returns—key ingredients that could help Kodiak achieve great growth seen in comparable copper explorers.

The Potential for Returns from Investing in Kodiak: Exploring the Advantages

If the rise of lithium and uranium have previously slipped under your radar, copper seems to be emerging as a major player in the realm of metals. It’s worth keeping an eye on for potential growth opportunities ahead of us all!

Kodiak appears to be a choice for leveraging the trend in copper’s value driven by three key factors at play:

- Perfect timing: Their first evaluation of assets coincides seamlessly with the spike in copper prices amid this market upswing.

- Multi-Discovery Potential: At Kodiak’s MPD project, the company already has 7 mineralized zones of significant copper mineralization plus have over 20 other targets that could add to the copper already discovered.

- Strategically Located: Situated in a strategic location within a prominent mining region that is well known to key players in the copper industry

The current value of the company is lower than what previous copper discoveries have been bought for in the past, but a mining analyst believes this difference will not last forever as major producers are likely to become interested in acquiring copper assets. The timing of Kodiak releasing their initial resource estimates could be serendipitous .In March 2025, the company secured funding to accelerate its exploration activities; however, despite its solid financial position and a string of prosperous exploration ventures, the company’s stock remains undervalued relative to its industry peers.

Investors must act swiftly to take advantage of the opportunity before it slips away

The shift towards clean energy and electrification is picking up speed quickly. Based on the projections from the World Bank, it is anticipated that the adoption of clean energy will require over 550 million tons of copper by 2050, which surpasses the total amount of copper extracted throughout human history.

The dwindling copper reserves and surging prices will lead to increased value for companies with significant holdings in this sector.

The opportunity presented by Kodiak Copper to benefit from this emerging trend is notable due to its exploration approach and the upcoming assessment of resources at a time when market conditions remain favorable.

Investors looking to capitalize on the rising demand for critical metals might consider Kodiak Copper as an option given its impressive findings and growth prospects aligned with the increasing value of copper.

To stay updated on the news and thorough updates from Kodiak Copper Company, visit their official website, and specifically check out the investor page for any announcements they release.

Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Please conduct your own research and consult with a professional financial advisor before making any investment decisions. The author may have investments in the securities mentioned in the article.

Disclaimer:

Copyright 2025 by Connect 4 Marketing, a Quebec Corporation. For more information, please contact [email protected] This is NOT an official website of Questrade, Interactive Broker, TD Ameritrade, Fidelity, Charles Schwab or Ortbiton Financial but the official website of investorstockpicks.com

To more fully understand any subscription, website, application, product, or other service (“Services”) including stocksbychatgpt.com, owned or operated by Connect 4 Marketing (together with its affiliates, owners, and control persons, the “Publisher”), please carefully read the disclosure below.

This is an issuer-paid advertisement. Kodiak Copper Corp. has paid Publisher CAD $14,500 in cash for marketing services, including communicating information about the Company to the Public. This advertorial (“advertisement” or “Advertorial”) is part of those issuer-paid marketing services. The contract with Kodiak Copper Corp. was effective on January 28, 2025 and continues until February 28, 2025 OR when advertising budget is exhausted (the “Term”), unless terminated by written notice of either party prior to the end of the Term or extended. As a result of this advertisement and other marketing efforts, Publisher may also collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, Publisher holds no securities of the Company and does not intend to purchase any securities during the Term. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of the Company, increased trading volume, and possibly an increased share price, which may or may not be temporary and could decrease once the marketing services have ended.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY

Not Investment AdviceThis advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Publisher cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of this Company or any company’s financial position. This advertisement or any statements made in it are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the Company that is the subject of the Advertorial or any other companies mentioned in this Advertorial, nor should they be construed as a personalized recommendation to buy, sell, or hold any position in any security mentioned in this Advertorial or any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED

Any individual who chooses to invest in the securities of the Company profiled in the Advertorial or any securities of the companies mentioned in this advertisement should do so with caution. Although this advertisement focuses on the positive features of the Company profiled and its securities, you must keep in mind that investing or transacting in these or any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Not an Investment Advisor or Registered Broker

Neither Publisher nor any of their owners, employees, or independent contractors is currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS

Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Publisher does not undertake an obligation to update forward-looking statements in light of new information or future events.

TRADEMARKS

All trademarks used in this advertisement are the property of their respective trademark holders, and no endorsement by such owners of the contents of the advertisement is made or implied.

Connect 4 Marketing Ltd. and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party.” The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation.”

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Connect 4 Marketing Ltd., its managers, employees, affiliates, and assigns (collectively the “Publisher”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

To the maximum extent permitted by law, the Company disclaims all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations provided herein prove to be inaccurate, incomplete, or unreliable, or result in any investment or other losses.

Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research.