As Trump calls to nuclear capacity in the US, from around 100 GW currently to around 400 GW by 2050, China has accelerated its nuclear buildout, faster than any major country.

Russia has quietly become China’s number one uranium trading partner. While Russia tightens its grip on global uranium supply, the U.S. faces an uncertain future as its 2028 Russian import ban approaches.

The urgency is certain: America currently produces just 200,000 pounds of uranium annually but requires 40 million pounds – a gap that is astounding.

While others scramble, Foremost Clean Energy (NASDAQ: FMST) is already securing resources in Canada—a stable, democratic jurisdiction the U.S. can turn to, to evade geopolitical tensions and any global shortages that may occur, and possible price spikes.

With its low-cost, high-grade assets in the Athabasca Basin, Foremost is uniquely positioned to address coming market demands while insulating American utilities from potential price spikes and supply disruptions.

The Foremost Advantage: Grade, Jurisdiction & Strategic Timing

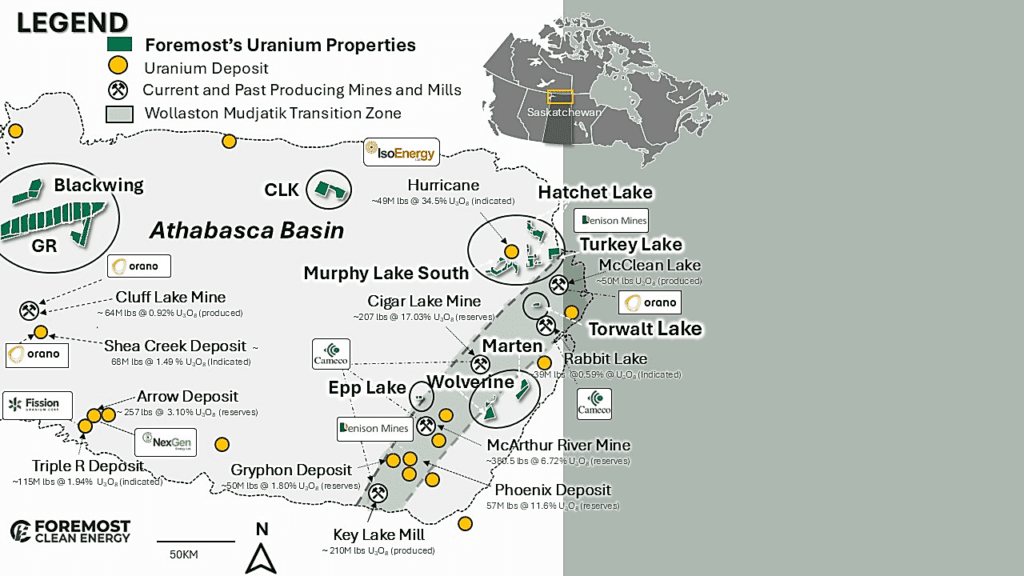

Foremost holds 10 strategic properties in Saskatchewan’s Athabasca Basin—the only jurisdiction where uranium grades routinely hit 10-100X global averages. These aren’t speculative claims; they’re in the same geological neighborhood as Cameco’s McArthur River (one of the world’s richest uranium mines).

The proof? FMST’s first inaugural drill program already intercepted 0.22% eU3O8 over 0.9 metres, within a 15-metre-wide zone—well above the 0.03-0.10% threshold for profitable ISR mining. This shows the immediate potential for their property, and the ability to provide feedstock to their partner Denison Mines in the exact mining method they are pioneering next door at Wheeler River.

Why This Matters Now

- Secure Supply Chain: Canada already supplies 25% of U.S. uranium needs—a relationship so vital that the Trump administration imposed only a temporary 10% tariff.

- Denison Partnership Denison, their largest shareholder, and with their CEO on its board, Foremost gains direct access to:

- ISR mining expertise (Denison is building Canada’s first ISR mine scheduled to begin operation in 2028)

- Future milling capacity

- Streamlined permitting pathways

The Trump administration’s mandate for energy security and increased nuclear capacity make this an ideal time to focus on low-priced uranium explorers like Foremost Clean Energy (NASDAQ:FMST).

Foremost’s uranium portfolio comprises 45 claims across 332,378 acres (134,509 hectares) surrounding and are near some of the world’s largest and highest-grade uranium operations, including the McArthur River and Cigar Lake mines.

Fig 3. Foremost’s Property Map Surrounded by Mines and Mills

Unlike other Athabasca explorers which focus on single projects, Foremost holds a diversified portfolio of 10 properties with multiple drill-ready targets. This diversification significantly boosts its chances of discovery while reducing risk, allowing it to pursue multiple promising targets concurrently, increasing its chances of making a major discovery. With uranium prices poised to rise and global demand accelerating, Foremost is perfectly positioned to capitalize on this opportunity.

With a strategic position in the legendary Athabasca Basin, the world’s richest uranium region, Foremost, isn’t just riding the wave of the clean energy transition – they’re helping to create it.

The Biggest 2025 Drilling Budget In The Area – $6.5 Million 2025 Exploration and Drill Program

Compared to peers, Foremost has the biggest drilling budget in the area. (See comparison table below)

| Company | 2025 Exploration Budget (CAD) |

|---|---|

| Foremost Clean Energy (NASDAQ:FMST) | $6,500,000 |

| IsoEnergy Ltd. (OTCQX:ISENF) | $5,000,000 |

| F3 Uranium Corp. (OTCQB:FUUF) | $5,000,000 |

Foremost is uniquely positioned with multiple discovery-ready properties supported by years of early-stage exploration and drilling work carried out by Denison. With a robust $6.5 million 2025 exploration program targeting high-grade discoveries and expansion of known mineralization, drilling is currently underway at its Hatchet Lake Uranium Property with additional drill programs planned this year at its Murphy Lake South, and CLK properties. Past drilling already confirmed uranium mineralization, including grades of up to 2.52% U3O8 at its Hatchet Lake property, highlighting the potential for significant discovery. Stay tuned for robust news flow on this exciting property!

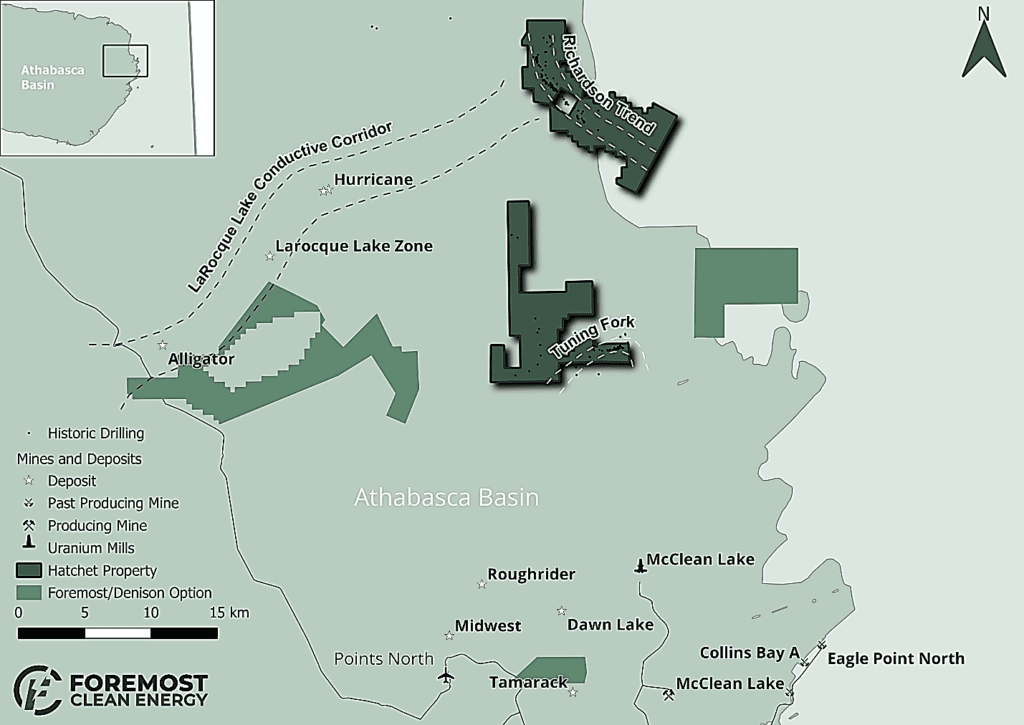

Planned drilling is targeting areas that are within or alongside significant structures and trends including the Wollasten Mudjatik Transition Zone and LaRoque Lake Conductive corridor, which is host to multiple occurrences of high-grade uranium mineralization, including IsoEnergy’s (TSX: ISO) Hurricane Deposit, known as the world’s highest grade uranium deposit with grades estimated at Indicated Mineral Resources of 48.6M lbs U3O8 from 63,800 tonnes at an average grade of 34.5% U3O82.

https://www.isoenergy.ca/featured-project/

Fig 4. Foremost’s Hatchet and Murphy Lake South Properties

Foremost Clean Energy Reports New Discovery of Uranium Mineralization at Hatchet Lake Property

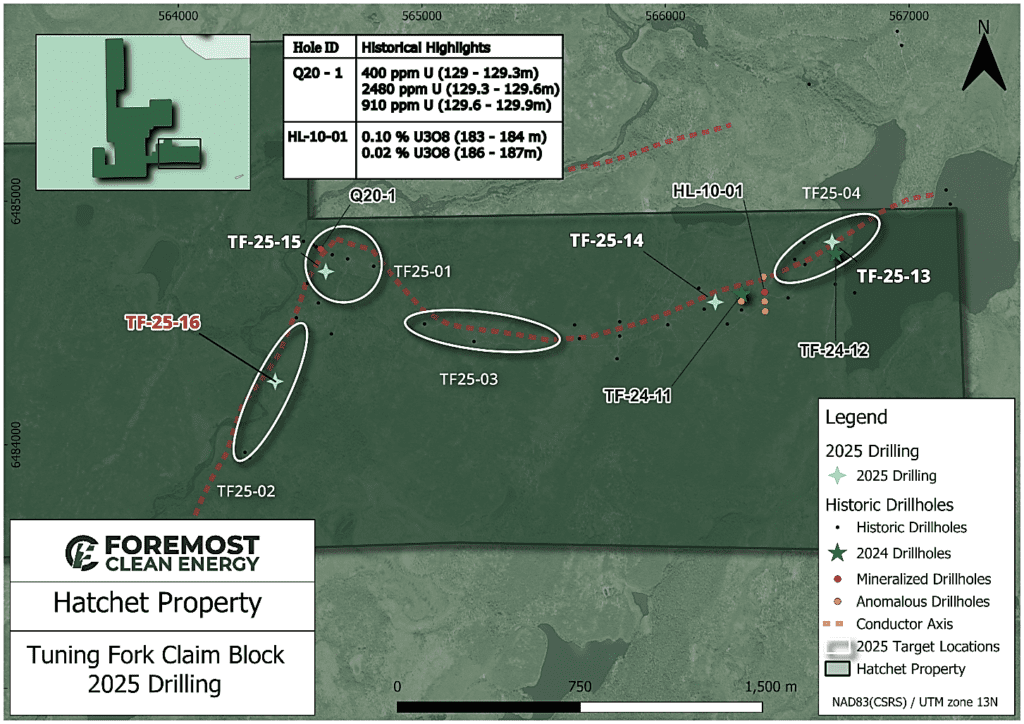

On May 01, 2025 Foremost provided an updated on its Hatchet Lake drill program, announcing that drill hole TF-25-16 intersected multiple mineralized intervals, including 0.22% eU₃O₈ over 0.9 metres, within a 15-metre-wide altered zone. The mineralization remains open along strike and at depth. The 2025 winter drilling campaign continues, with plans for follow-up on this discovery and testing of additional targets.

Figure 5 – Location of 2025 Hatchet Drill Program holes and historical drillholes

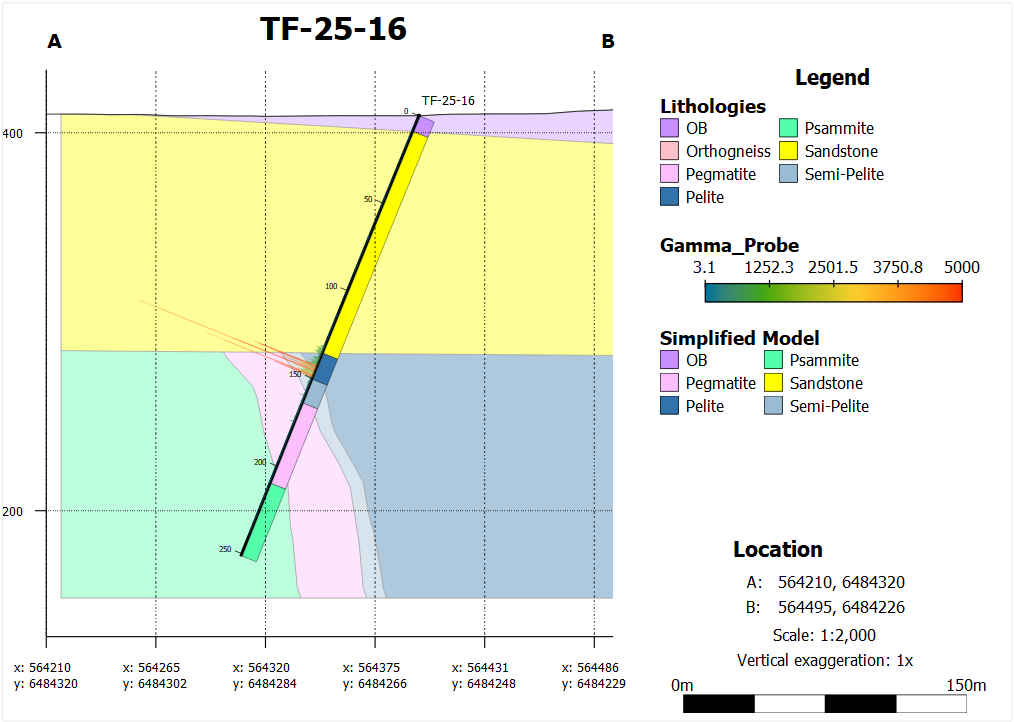

Figure 6 – Drill hole TF-25-16 with downhole gamma probe data and logged lithologies. The elevated radioactivity is at and below the unconformity (boundary between the sandstone and underlying rocks)

Picture 1 – Core photos displaying strong alteration over the elevated gamma probe reading interval

Next Steps:

- Continued further drilling to expand the mineralization zone

- Continued analysis of core samples and geophysical data

“What sets Foremost apart is that we’re not starting from scratch. This discovery validates our strategic partnership with Denison Mines. Their historical exploration work gave us a clear roadmap, allowing us to immediately focus on high-priority targets and uncover new mineralization in our first program. With drilling ongoing, we’re prioritizing follow-up on this discovery while testing additional targets identified through Denison’s groundwork. These results demonstrate the exceptional potential of our uranium portfolio and the quality of projects we’ve optioned from Denison.”

– Jason Barnard-President and CEO, Foremost

Why Foremost Clean Energy?

Prime Real Estate: It has 10 properties in the Athabasca Basin, boasting uranium grades 10 to 100 times higher than the global average. Projects surrounded by known deposits, mines and mills and considerable existing infrastructure.

Powerhouse Partnership: Backed by Denison Mines (NYSE: DNN, TSX: DML), a $1.95 Billion uranium developer with nearly ~20% ownership offering unparalleled expertise and access to Denison’s operational, technical, and financial backing including board representation by their President and CEO.

Unique Market Position: One of the only Nasdaq-listed uranium explorers in the Athabasca Basin presenting a unique opportunity for investors looking to gain exposure to western uranium assets still in the growth stage. This positioning allows Foremost to capitalize on the growing demand for uranium, especially as the market looks beyond established producers.

Diversified Portfolio: Currently drilling on multiple discovery-ready targets, on over 330,000 acre prospective uranium land package with a fully funded $6.5Million budget with an additional upside potential from lithium projects in Manitoba and Quebec.

Tight Capital Structure & Low Float: Tightly held, with only ~10.3M shares outstanding with significant insider holding, positioned for rapid upside on discovery news.

Why Consider Investing Now?

With a Nasdaq listing providing liquidity, a proven exploration team, and Denison’s execution expertise, Foremost offers rare exposure to high-leverage uranium exploration in a stable jurisdiction. As drilling progresses in 2025, the market is likely to re-rate Foremost (Nasdaq: FMST, CSE: FAT) toward peers like CanAlaska (TSX:CVV), AthaEnergy )(TSX: SASK) which trade at significantly higher valuations. Foremost is also strategically positioned to benefit from recent geopolitical developments, particularly the escalating trade tensions between the U.S. and China. These tensions have led to significant disruptions in the global supply of critical minerals, presenting opportunities for companies like Foremost that are based in stable, resource-rich countries such as Canada.

“Foremost Clean Energy represents a unique investment opportunity in the uranium space. Their diversified portfolio in the Athabasca Basin, combined with the Denison Mines partnership, positions them for significant discovery potential. With a $5.45USD price target, we see over 500% upside potential from current levels.”

– Zacks Small-Cap Research Analyst Report

Bottom Line: Foremost Clean Energy is a unique, catalyst-rich play on the uranium bull market, combining high-grade assets, strategic partnerships, and near-term drilling news flow. Investors gain leveraged exposure to nuclear energy’s pivotal role in the clean energy transition—backed by a tight share structure and institutional support. At current levels, Foremost Clean Energy represents a high-conviction opportunity ahead of exploration results and broader uranium price appreciation.

Secure Your Position in the Clean Energy Revolution.

Invest in Foremost Clean Energy (NASDAQ: FMST, CSE: FAT) today and power your portfolio with the fuel of the future.

Receive updates on Foremost Clean Energy’s project advancement directly to your inbox.

Disclaimer: This investment involves risks. Please read our full disclaimer and conduct your own due diligence before investing.

Copyright 2025 © Investorstockpicks.com is owned and operated by Connect 4 Marketing Ltd., a Quebec Corporation. For more information, please contact [email protected]. This is NOT an official website of Ortbiton Financial but the official website of investorstockpicks.com.

To more fully understand any subscription, website, application, product, or other service (“Services”), owned or operated by Connect 4 Marketing (together with its affiliates, owners, and control persons, the “Publisher”), please carefully read the disclosure below.

This is an paid advertisement. LFG Equities has paid the Publisher USD $40,621+HST for marketing services, including communicating information about the Company to the Public and paid advertising budget. This advertorial (“advertisement” or “Advertorial”) is part of those issuer-paid marketing services. The contract with LFG Equities was effective on April 30, 2025 and continues until advertising budget is exhausted (the “Term”), unless terminated by written notice of either party prior to the end of the Term or extended. As of the date of this advertisement, Publisher holds no securities of the Company and does not intend to purchase any securities during the Term. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of the Company, increased trading volume, and possibly an increased share price, which may or may not be temporary and could decrease once the marketing services have ended.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We do not own shares in (FMST). This compensation is a major conflict of interest in our ability to be unbiased. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Connect 4 Marketing Ltd. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY

Not Investment Advice. This advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Publisher cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of this Company or any company’s financial position. This advertisement or any statements made in it are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the Company that is the subject of the Advertorial or any other companies mentioned in this Advertorial, nor should they be construed as a personalized recommendation to buy, sell, or hold any position in any security mentioned in this Advertorial or any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED

Any individual who chooses to invest in the securities of the Company profiled in the Advertorial or any securities of the companies mentioned in this advertisement should do so with caution. Although this advertisement focuses on the positive features of the Company profiled and its securities, you must keep in mind that investing or transacting in these or any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Not an Investment Advisor or Registered BrokerNeither Publisher nor any of their owners, employees, or independent contractors is currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.

USE OF FORWARD-LOOKING STATEMENTS

Certain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Publisher does not undertake an obligation to update forward-looking statements in light of new information or future events.

TRADEMARKS

All trademarks used in this advertisement are the property of their respective trademark holders, and no endorsement by such owners of the contents of the advertisement is made or implied.

Connect 4 Marketing Ltd. and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party.” The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation.”

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Connect 4 Marketing Ltd., its managers, employees, affiliates, and assigns (collectively the “Publisher”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

To the maximum extent permitted by law, the Company disclaims all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations provided herein prove to be inaccurate, incomplete, or unreliable, or result in any investment or other losses.

Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research.