Why Tariffs Are Back on Center Stage

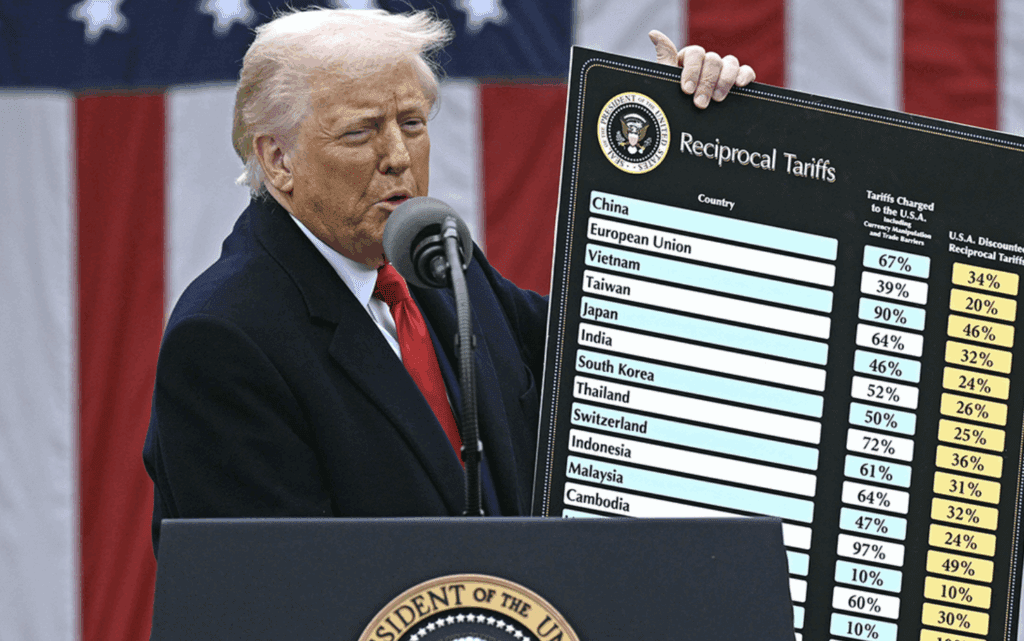

The world thought the 2018–2020 “trade-war” era was behind us. Yet 2025 has seen tariff tensions roar back:

- The United States has more than doubled average duties on Chinese goods to 51 percent and imposed steep new levies on steel, aluminum and critical technologies. (piie.com)

- China has retaliated, lifting its own average tariff to 32 percent and curbing exports of rare-earth alloys, magnets and other critical minerals, jolting global auto and electronics supply chains. (reuters.com)

- A July 9 deadline now looms for Europe: unless a deal is struck, Washington will slap 50 percent duties on EU imports, while Brussels prepares mirror-image retaliation. (barrons.com, reuters.com)

- The EU’s Carbon Border Adjustment Mechanism (CBAM) enters its final transitional year, adding a “carbon tariff” layer on steel, cement and fertilizer by the end of 2025. (taxation-customs.ec.europa.eu)

For CEOs, supply-chain managers and investors, the next two quarters will be decisive. Below is an actionable roadmap — rooted in today’s headlines and SEO-friendly keywords — to help you navigate the tariff war and safeguard growth.

1. Key Flashpoints to Watch Through Q4 2025

1.1 United States × China: Negotiation Window vs. Escalation Risk

| Decision Point | Why It Matters | Probable Scenarios (July-December 2025) |

| Possible Trump–Xi summit (date TBC) | A handshake could freeze tariff hikes or swap cuts for fentanyl-control concessions. | 40 % chance of a partial tariff rollback; 60 % chance of status quo with rolling exemptions. (barrons.com) |

| Section 301 review of consumer electronics | Could extend 25 % tariffs to smartphones/laptops; retailers fear holiday-season shocks. | If no deal, expect new 10-25 % duties effective October 1. |

| Rare-earth export curbs | China controls ~70 % of global processing; auto & defense sectors are exposed. (reuters.com) | Curbs likely stay until a grand bargain; customers fast-track non-China sourcing. |

1.2 United States × European Union: The July 9 Steel-and-Aluminum Cliff

- Tariff timeline. Trump’s “best-offer” ultimatum expires July 9. If talks fail, 50 % duties on EU metals and possibly autos kick in the same week. (reuters.com)

- EU response. Brussels has drafted a retaliatory list targeting U.S. farm goods and iconic brands; measures could start by mid-July. (barrons.com)

- CBAM overlap. From Q4 2025, EU importers must file quarterly carbon-intensity reports; embedded-emission levies arrive in 2026. (trade.ec.europa.eu)

SEO keywords: US-EU metal tariffs, July 9 deadline, CBAM reporting 2025

1.3 China × ASEAN: Quiet Winners Emerge

Facing U.S. pressure, China has redirected exports:

- ASEAN now absorbs 20 % of Chinese shipments, surpassing the U.S. share of 10.5 %. (ainvest.com)

- High-tech equipment (industrial robots, 3-D printers) and new-energy vehicles are leading the surge.

- An upgraded China-ASEAN Free Trade Area is scheduled for October 2025, cementing lower tariffs inside the bloc. (ainvest.com)

2. Sector-by-Sector Outlook

2.1 Metals & Mining

- Steel & aluminum: Expect extreme price volatility around the July 9 U.S.–EU deadline; buyers should lock in forward contracts now. (reuters.com)

- Critical minerals: Automakers face 8-to-12-week delivery delays on magnet alloys; hedge by sourcing from Australia, Canada or U.S. startups receiving Inflation Reduction Act grants. (reuters.com)

- Gold & copper: Protectionist sentiment has historically lifted safe-haven demand; miners with North American assets enjoy relative insulation.

2.2 Autos & EVs

| Risk Factor | Timeline | Mitigation Strategy |

| Rare-earth supply shock | Immediate | Expand non-China sourcing (Lynas, MP Materials). |

| Potential 25 % U.S. tariff on EU-made vehicles | July–September | Consider final assembly in Mexico (USMCA duty-free). |

| China EV export redirection to ASEAN | Ongoing | Watch for price-cut pressure in emerging markets. (ainvest.com) |

2.3 Technology & Consumer Electronics

- A Section 301 list expansion could slap tariffs on laptops, tablets and smartphones — disrupting peak-season inventories. Keep contingency stock in bonded warehouses and explore Vietnam/India assembly.

- Cloud providers brace for higher server costs (tariffs on Chinese semiconductors), potentially squeezing margins in Q4 2025.

2.4 Agriculture & Food

EU retaliation may target U.S. soybeans, citrus and whiskey. U.S. farmers remember 2018-19 pain; crop-insurance take-up is rising.

3. Five Action Steps for Business Leaders

- Map your tariff exposure down to the HS-6 level. Take advantage of “first sale” and “de minimis” exemptions where possible.

- Restructure supply chains with a “China-Plus-Two” model. ASEAN and Mexico are front-runners, but Central/Eastern Europe offer proximity to EU clients. (gosonar.com)

- Use duty-drawback and foreign-trade zones (FTZs). U.S. importers can reclaim duties on re-exports or delay payment until goods leave an FTZ warehouse.

- Hedge commodity price swings. Lock in futures or options for steel and copper ahead of tariff cliff dates.

- Stay CBAM-ready. Begin collecting cradle-to-gate emissions data now; from 1 October 2025 only EU-approved reporting is allowed. (taxation-customs.ec.europa.eu, e2open.com)

4. Investment & Market Strategy

4.1 Equity Plays

- North American rare-earth miners and ASEAN industrial parks (Vietnam, Malaysia) stand to benefit.

- Logistics & port operators in Mexico and Thailand see volume upside as rerouted trade grows.

- Firms with a high “tariff-insulated revenue share” (domestic utilities, healthcare) offer defensive positioning.

4.2 Fixed Income and FX

- Sovereign yields of open, trade-dependent economies (Korea, Taiwan) may widen versus U.S. Treasuries if tensions linger.

- Expect dollar strength around tariff-announcement dates as risk-off flows rise, but watch for euro rebounds if a U.S.–EU compromise emerges.

4.3 Commodities & Hedging

Gold historically rallies on trade-war headlines; consider a small strategic allocation. For corporates, tariff insurance — now offered by specialized brokers — can offset customs costs if hikes exceed contract thresholds.

5. What Comes Next? An Event Calendar

| Date | Event | Why It’s Critical |

| July 9 2025 | U.S.–EU deadline on steel/aluminum tariffs | Triggers 50 % duties if no deal |

| TBD (Q3 2025) | Possible Trump–Xi call | Could freeze or roll back tariffs |

| Sept 30 2025 | End of USTR Section 301 comment period | Foreshadows electronics tariff list |

| Oct 2025 | China-ASEAN FTA upgrade | Cuts intra-Asia tariffs, boosts rerouting |

| Dec 31 2025 | End of CBAM transitional reporting year | Sets stage for carbon levies in 2026 |

Conclusion

The 2025 tariff war is no longer a headline risk — it is a boardroom reality. Whether you ship finished goods across oceans or manage a regional service portfolio, proactive tariff strategy will separate winners from laggards over the next six months.

Frequently Asked Questions (FAQ)

- Will tariffs definitely rise in July 2025?

Not necessarily. If U.S.–EU talks succeed, metals duties could be delayed or softened, but companies should still scenario-plan. (barrons.com) - Could China lift its rare-earth export ban quickly?

Unlikely before substantive progress with Washington; the ban is one of Beijing’s strongest bargaining chips. (reuters.com) - How does CBAM differ from traditional tariffs?

CBAM is a climate-policy tool: importers pay a levy equal to the CO₂ price European producers face, starting in 2026 after a data-collection phase. (taxation-customs.ec.europa.eu) - Are there tax credits or grants to offset new U.S. tariffs?

Yes. The CHIPS & Science Act and Inflation Reduction Act offer incentives for domestic semiconductor and battery production, effectively counter-balancing some tariff costs.