Key Insights into TCL Zhonghuan Renewable Energy Technology Co., Ltd. Stocks

Examining the shareholders of TCL Zhonghuan Renewable Energy Technology Co., Ltd. (SZSE:002129) provides insight into which group holds the most power within the company. Individual investors dominate with a substantial 56% ownership stake, suggesting that they will realize the greatest benefit from stock price increases and bear the most risk in the event of a downturn.

Shareholder Composition: A Deeper Dive

The company’s public entities, which include various public companies, collectively own 30% of the outstanding shares. This breakdown showcases a diverse ownership structure, inviting various stakeholders into the company’s governance and decision-making processes. To gain a clearer perspective, let’s explore the ownership dynamics further, starting with the visual representation below.

The Role of Institutional Investors in Stock Performance

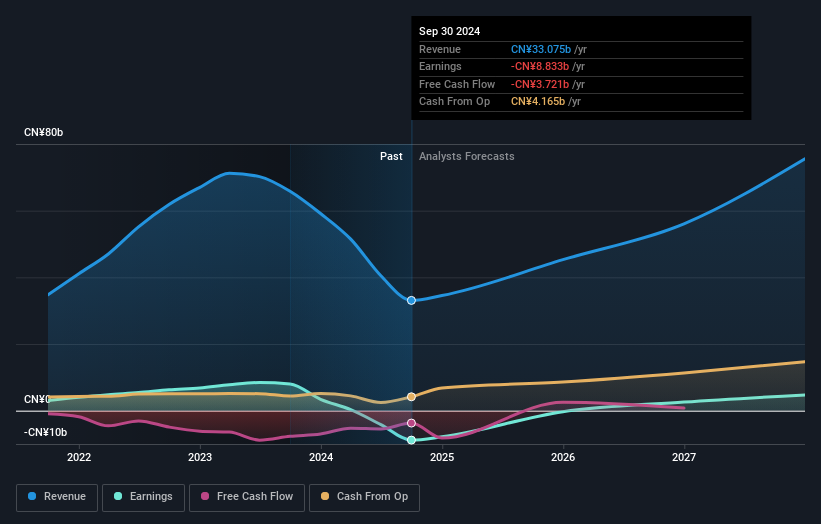

Institutional investors play a significant role in the stock market, often benchmarked against widely tracked indices. Their presence in TCL Zhonghuan Renewable Energy Technology Ltd is considerable, indicating a level of credibility among professional investors. However, it’s important to remember that institutional investors can also make poor decisions, leading to sharp stock price declines if several institutions withdraw their support concurrently. A look at the company’s earnings history is crucial for a comprehensive analysis, but ultimately, future prospects are paramount.

Hedge Funds and Major Shareholders

An analysis of hedge fund investments reveals that they lack significant stakes in TCL Zhonghuan Renewable Energy Technology Ltd. The largest shareholder is TCL Technology Group Corporation, holding 30% of shares. The second and third largest shareholders possess 2.3% and 1.0%, respectively. Interestingly, a review of the top shareholders indicates that the top 25 collectively control less than 50% of the shares, highlighting an absence of any single dominant stakeholder with majority interests.

Insider Ownership and Its Implications

Insider ownership is also a metric worth examining. Here, insiders, which include board members, collectively own just under 1% of the company’s shares, valued at approximately CN¥36 million. While their ownership stake is minimal, it’s reassuring to see executive leadership having a financial interest in the company, indicating a shared commitment. However, one should consider tracking insider purchases to gauge confidence levels better.

The General Public’s Influence on Company Decisions

The general public, encompassing retail investors, holds a notable 56% ownership in TCL Zhonghuan Renewable Energy Technology Ltd. This level of public ownership allows everyday investors to exert considerable influence on vital company decisions, including board selection, executive pay, and dividend distributions, highlighting the power dynamics at play in such a publicly traded entity.

Strategic Positions of Public Companies

Public companies comprise 30% of the total stock ownership, possibly indicating a strategic partnership or collaboration among businesses in related sectors. Understanding the motivations behind this investment can provide additional context to the company’s market position and growth strategies.

Conclusion: Beyond Ownership Insights

Exploring ownership structures provides valuable insights into a company’s stability and potential trajectory. While it’s engaging to look at who owns TCL Zhonghuan Renewable Energy Technology Ltd, it’s essential to consider other facets that can impact stock performance.