The price of gold has risen to a record high of more than +USD 3,300 (April 16, 2025) per ounce for the first time in recent weeks, due to the escalating trade tensions between the USA and China and increasing geopolitical uncertainties, but also to the continued high demand from central banks .

Given these developments, investors continue to turn to gold as a safe haven. Central banks have continued their robust trend of gold purchases, with 2024 being the 15th consecutive year of net purchases.

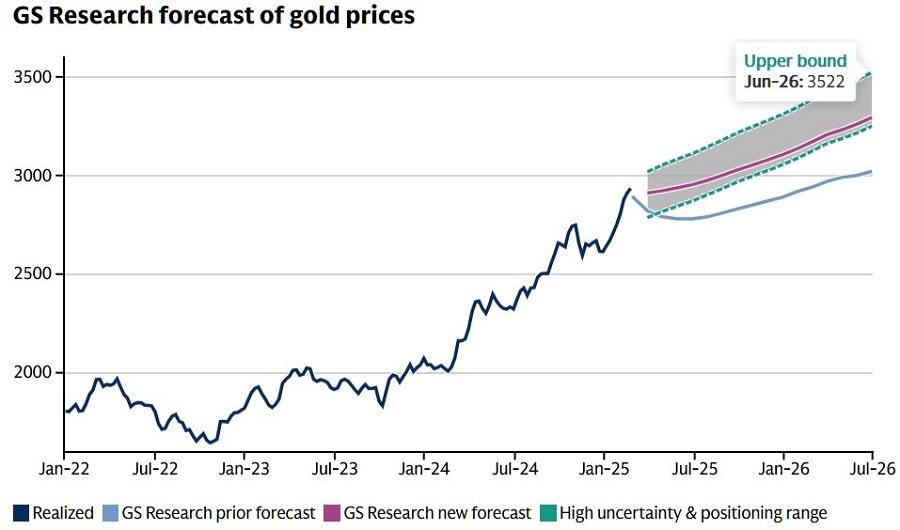

Analysts believe that the upward trend in the price of gold could continue, and Goldman Sachs’ forecast suggest that the price could reach the $4,000 per ounce mark within the next 12 months as investors seek stability amid ongoing economic and geopolitical challenges .

Junior explorers and small caps from the gold sector offer the greatest opportunities for investors. You will find 10x potential, but also high volatility.

If gold sustainably exceeds the $3,000 mark, gold exploration companies are likely to benefit the most. That’s where top emerging companies like QUIMBAYA GOLD (CSE: QIM / OTC: QIMGF / WKN: A3DT3C) come in. The company owns three world-class gold projects, located near well-known industry players, and is led by a world-class management team.

Couloir Capital has an initial price target of CAD 1.00 for Quimbaya Gold Inc. (QIM.CN). This represents a potential increase of 117% from the current price of $0.4950. The analysts at Couloir recommend buying Quimbaya Gold. (April 15, 2025)

Recommended By:

More than 100% Potential: Analysts Recommend Buying Quimbaya Gold!

– Gold Invest’s Editorial Team

We recommend Quimbaya Gold as a buy for investors seeking exposure to high-impact gold exploration in Colombia’s Segovia mining camp. With gold prices at new highs, the Company’s upcoming drill program presents a promising opportunity. Our initial target price for the stock is C$1.00.

– Couloir Capital Analysts

Quimbaya Gold (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) stock is currently one of the most exciting opportunities on the market and an absolute highlight for any investor who wants to benefit maximally from the current gold price rally! With a gold price that has recently broken through the magic mark of over USD 3,000 per ounce, the yellow precious metal is in the spotlight as never before – and Quimbaya Gold is perfectly positioned to convert this momentum into impressive price gains. Here are the reasons why you should strike NOW:

Quimbaya Gold (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) is currently one of the most exciting opportunities on the market — a standout for any investor looking to maximize gains from the ongoing gold price rally. With gold recently breaking through the key threshold of USD 3,000 per ounce, the yellow metal is commanding unprecedented attention — and Quimbaya Gold is perfectly positioned to capitalize on this momentum with the potential for significant price gains. Here’s why now is the time to act:

HIGHLIGHTS ON QUIMBAYA GOLD (CSE:QIM / OTC: QIMGF / WKN: A3DT3C)

- Strategic Location: Direct neighbor of Aris Mining (TSX: ARIS), Colombia’s leading gold producer.

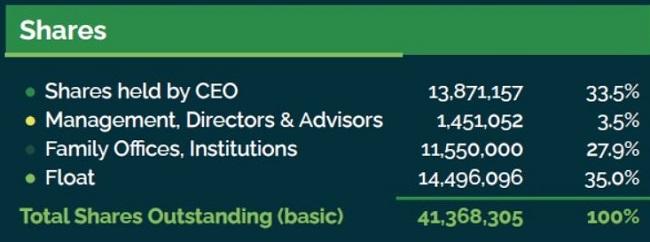

- High Insider Ownership: Management holds approximately 37% of all outstanding shares, with 33.5% owned by the CEO alone — a strong vote of confidence. Both the CEO and CFO have recently increased their positions through additional share purchases.

- Proximity to Exploration Success: Another key project is located northeast of Collective Mining (TSX: CNL), one of the top exploration success stories in recent years (+375% in 2 years).

- Expert Team: Dr. Stewart Redwood, a key figure in the discovery of Aris Mining’s Marmato Gold Mine, is now part of the Quimbaya Gold team.

- Proven Exploration Leadership: VP of Exploration Ricardo Sierra previously worked at Continental Gold, which was acquired by Zijin Mining in 2020 for approximately USD 1.4 billion.

- Experienced Local Leadership: CEO has over 10 years of experience operating in Colombia, providing valuable local expertise and relationships.

- Strong Financial Position: High cash balance following successful financing rounds.

- Attractive Valuation: Still at an early stage with a low valuation and only ~15 million shares in free float.

- Phase 1 Drilling at Tahami: Located adjacent to Aris Mining’s multi-million-ounce gold operation. A fully funded 4,000-metre drill program has just been announced — with all costs to be covered through shares, preserving cash reserves.

Gold is soaring — and if you’ve been tracking the price action, you’ll know that the yellow metal is no longer just the domain of central banks and doomsday preppers.

UBS and JP Morgan have recently raised their gold price targets to $3,000 per ounce over the next 12 months, and we believe they’re spot on — if not conservative.

Quelle: LBMA, Goldman Sachs Research

Mentioned In:

Let’s take a closer look.

Gold recently surged past USD 3,000 per ounce, surpassing UBS’s long-standing forecast — and the price action tells a clear story: demand remains unrelenting.

According to the World Gold Council, global gold demand reached a record 4,974 tonnes in 2024.

And who are the biggest buyers?

Central banks.

They’ve been net buyers for three consecutive years and have already purchased over 1,000 tonnes in 2024 alone.

These aren’t just numbers — this is real, sustained buying pressure.

Now consider the broader backdrop:

Heightened geopolitical tensions, stubborn inflation, and growing expectations of Fed rate cuts. Gold is the ultimate “risk-off” trade, and right now, it’s proving why it has held that reputation for centuries.

UBS now forecasts gold will hold at $3,000/oz through the end of 2025, driven by slowing global GDP growth and a more aggressive Fed easing cycle — both scenarios becoming more likely by the day.

Goldman Sachs agrees, recently raising its gold target from $2,890 to $3,100/oz by December 2025.

Those: ibisingold.com

The recent increase in gold price targets is primarily driven by sustained demand from central banks.

Goldman Sachs notes that if political uncertainties — including concerns over tariffs — persist, gold could climb to $3,300/oz by the end of this year. Looking further ahead, they see $3,522/oz as a realistic target by June 2026.

One of the most compelling insights from Goldman’s analysis is their view of gold as a barometer of both fear and prosperity. We’ve seen this dual role play out during previous market crises — in 2000, 2008, and 2020 — when gold surged amid stock market turmoil.

But this time, the shift is becoming structural. Why? Because central banks are increasingly hoarding gold as an alternative to the dollar-based system — a trend that’s reshaping the long-term outlook for the precious metal.

So how can we make money with it?

In our opinion, the best way to participate in gold’s upward trend is to have a mix of large producers and high-quality small caps such as Quimbaya Gold (CSE:QIM / OTC: QIMGF / WKN: A3DT3C).

Big companies: The big names like Barrick Gold and Newmont offer stability, solid dividends, and leverage on higher gold prices. These are the “safe” values if you want to get involved without wild fluctuations.

Medium-sized and small companies: If you are looking for a higher risk and return, medium-sized gold mining companies will be interesting for you. Companies such as Agnico Eagle, Kinross Gold or Yamana Gold offer more potential than the large mining companies but still have strong established production.

Explorers & Small Caps: Here you will find 10x potential, but also high volatility. If gold crosses the $3,000 mark, these companies will be the first and hardest hit. This is where companies like QUIMBAYA GOLD (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) come into play, which owns 3 first-class gold projects with well-known neighbours and a world-class management team.

Junior gold stocks like QUIMBAYA GOLD are the growth engines of the commodities sector. These are the companies that discover new resource deposits and are often acquired by major producers at significant premiums. For investors, they offer exposure to extraordinary profit potential.

Early investors can benefit from massive price surges when new gold discoveries are made or when projects attract takeover offers from large mining companies — both scenarios are firmly on the table with today’s featured stock.

QUIMBAYA GOLD (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) is an emerging, highly agile exploration company focused on gold projects in Colombia. Its current pipeline includes three distinct project areas located in Antioquia, Colombia’s most important and prolific mining district.

DIRECT NEIGHBOR TO ONE OF THE HIGHEST-GRADE GOLD MINES IN THE WORLD

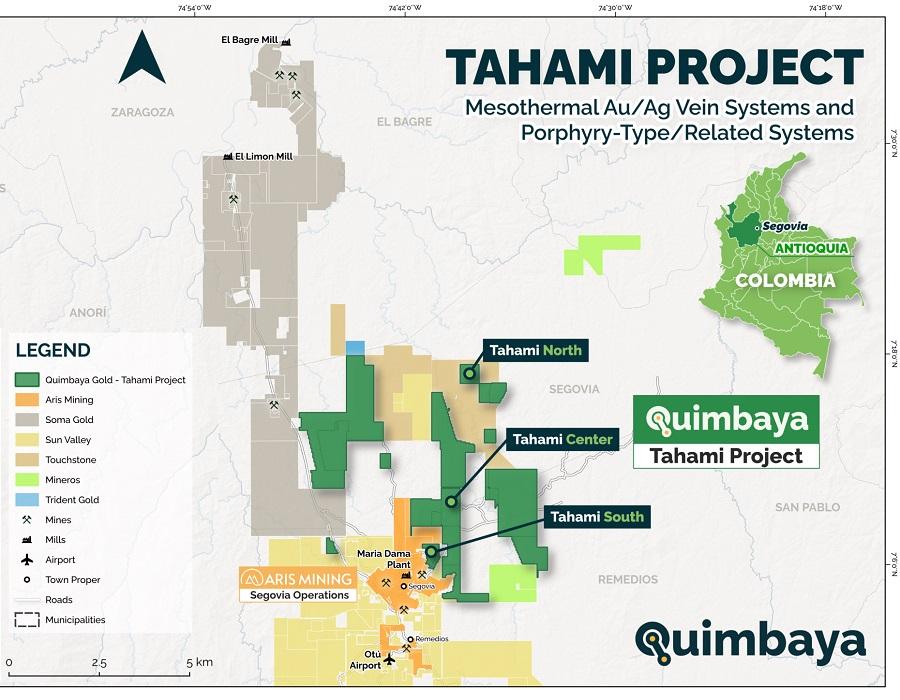

Quimbaya Gold’s Tahami Project is strategically located right next to Aris Mining’s (TSX: ARIS) highly profitable gold operation — one of the highest-grade gold mines globally. Aris Mining currently boasts a market capitalization of CAD 1.1 billion, while Quimbaya Gold is still undervalued at just around CAD 19 million.The upside potential here is clear — especially given the project’s location and proximity to a proven, world-class gold producer.

Source: Quimbaya Gold

The Segovia Mine, operated by neighboring Aris Mining, boasts reserves of over 1.3 million ounces of gold at an impressive grade of 10.8 g/t Au. Its Measured & Indicated Resource totals 3.4 million ounces, grading 16.1 g/t Au, making it one of the highest-grade gold mines in the world.

In 2024, Segovia is set to produce approximately 185,000 ounces of gold, with 2025 production forecasted at 210,000–250,000 ounces. Over the medium term, output is expected to rise to around 400,000 ounces annually.

Quimbaya Gold’s Tahami Project is strategically located next to this prolific operation, offering several key advantages:

- Proximity to significant deposits, enhancing discovery potential.

- Access to vital infrastructure, including ample electricity and water, which streamlines exploration and future development.

- Close proximity to Aris Mining’s processing facilities, which are currently being upgraded from 2,000 tpd to 3,000 tpd. Notably, Aris currently processes less than 50% of its own ore, with the balance sourced from third-party suppliers — presenting a potential opportunity for nearby producers like Quimbaya.

DRILLING COMPANY BECOMES A SHAREHOLDER IN QUIMBAYA GOLD (March 3, 2025)

Quimbaya Gold may be on the verge of a major exploration success. The company has just announced a fully funded 4,000-metre drill program, with a remarkable twist — Independence Drilling, the contracted service provider, has agreed to accept a block of shares in lieu of the typical CAD 1.2 million cash payment.

This kind of arrangement is rare in the mining industry and highlights Independence Drilling’s exceptional confidence in the potential success of Quimbaya’s Tahami project.Meanwhile, Quimbaya’s other two projects — Maitamac and Berrio — are set to undergo further early-stage exploration programs, expanding the company’s pipeline in Colombia’s most prolific gold district.

Alexandre P. Boivin, President and CEO of Quimbaya Gold, stated:

“With the commencement of drilling, we are able to capitalize on our prime location adjacent to Aris Mining’s world-class Segovia operation. This program is our first step in unlocking the immense potential of Tahami South, where historical data indicates high-grade gold systems.” (March, 2025)

Source: Quimbaya Gold

The company plans to keep shareholders informed with regular updates over the coming weeks and months, providing key insights into major developments, milestones, and exploration results as they become available.

QUIMBAYA GOLD (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) is positioning itself as one of the most promising emerging players in the gold mining sector. With high-grade exploration projects located in resource-rich regions of Latin America, Quimbaya is poised to make a significant impact.By combining cutting-edge exploration techniques with a seasoned management team boasting an impressive track record, Quimbaya Gold is well-equipped to seize market opportunities and deliver strong value to its shareholders.

Quimbaya Gold has two other projects: Maitamac and Berrio

In addition to the Tahami Project, where Aris Mining serves as a prominent neighbor, Quimbaya Gold has two other highly promising projects in its portfolio — and one of them is attracting particular attention.

The Maitamac Project stands out as especially compelling. Located just a few kilometers northeast of Collective Mining (TSX: CNL), Maitamac sits in a region that has already delivered spectacular drilling successes — and generated significant wealth for early investors.

Collective Mining made global headlines with exceptional drill results, drawing attention from the mining and investment sectors. At its Guayabales Project, the company reported an astonishing 150 metres of 6.16 g/t AuEq within a 534-metre interval of 2.70 g/t AuEq — truly world-class results that fully justifies the stock’s price surge, as demonstrated in the chart below.

As exploration activity heats up in the region, Maitamac’s location and potential place Quimbaya Gold in a prime position to deliver similarly exciting results.

Source: stockwatch.com

The ingenious part? Quimbaya Gold’s Maitamac Project lies just a few kilometers northeast of Collective Mining — and there’s a real possibility they share the same mineral trend.

Located in the southern part of Antioquia, Maitamac is Quimbaya’s largest property by area, spanning 33,223 hectares. Geologists regard this district as highly prospective for gold/copper porphyry systems with substantial discovery potential.

Notably, underground mining in the area has encountered mineralized shoots averaging 26 g/t gold, with grab samples assaying up to 96 g/t gold — highlighting the area’s exceptional mineralization.

Quimbaya’s third project, Berrio, is located in eastern Antioquia and covers 8,746 hectares, of which 7,529 hectares are pending final approval. Historical drilling at Berrio has delivered standout intercepts, including 98 g/t gold, and 16.3 metres averaging 11.15 g/t gold — further proof of the district’s rich gold potential.

With three high-potential projects in Colombia’s most prolific mining region, Quimbaya Gold is strategically positioned to unlock substantial exploration success and long-term value.

WHY COLOMBIA?

Colombia is widely regarded as the most underexplored country in Latin America, despite its rich geological landscape and abundance of mineral-rich ore deposits. This untapped potential makes it a prime destination for junior exploration companies — and Quimbaya Gold is at the forefront.

The company is backed by a highly experienced technical and leadership team with a proven track record of success:

- Dr. Stewart Redwood, instrumental in the discovery of Aris Mining’s Marmato Gold Mine, now serves as Senior Technical Advisor at Quimbaya Gold. From 2007 to 2010, he was Senior Consultant Geologist at the Marmato Mine, and now brings his deep geological expertise and insights to support Quimbaya’s exploration efforts.

- Ricardo Sierra, VP of Exploration, previously worked with Continental Gold, which was acquired by Zijin Mining in 2020 for approximately USD 1.4 billion. Early investors in Continental saw significant gains as the company strategically upgraded its resources. Ricardo also served as Exploration Manager at Collective Mining and has 18 years of geological experience across Colombia, Brazil, Cuba, and Chile.

- Alexandre P. Boivin, CEO of Quimbaya Gold, has over 10 years of experience in Colombia and is deeply invested in the company’s success. He is the largest single shareholder, holding approximately 13.9 million shares — 33.5% ownership — a strong indicator of alignment with shareholder interests and confidence in the company’s future.

Source: Quimbaya Gold

- Colombia is home to vast, previously untapped gold deposits and maintains a mining-friendly policy environment, making it an increasingly attractive destination for exploration and development.

- Situated in the Andean Gold Belt — one of the most prolific mining regions in the world — Colombia offers exceptional geological potential. The country also benefits from an active community of small-scale miners and artisans, contributing to a robust and dynamic mining ecosystem.

- Notably, Colombia has a fast-track permitting process: large mining projects can receive approval within just 10 months, significantly accelerating the path to production.

- The current government has demonstrated its support for the sector, having issued seven mining permits over the past 2.5 years, including authorization for open-pit mining operations.

- With high-grade gold deposits and a rapidly growing formal mining industry, Colombia has attracted major global players such as Glencore, AngloGold Ashanti, Xstrata, and Anglo American, all of whom are actively investing in the country’s resource potential.

Quimbaya’s projects are located in the country’s geological hotspot: Antioquia accounts for 50% of Colombia’s gold production. In addition to Aris Mining’s Segovia and Buriticá from Zijin Mining (formerly Continental Gold) is also the country’s second major gold project.

Quimbaya Gold itself will start drilling at its Tahami project in Q2 2025. Aris Mining and its high-grade, world-class Segovia gold mine, which is directly adjacent, should have attention and excitement.

The very high insider ownership of 37% and the strong confidence of the CEO, who personally holds 33.5% of all shares, speak for themselves.

Given the promising geology in close proximity to producing gold mines, the stock—currently still undervalued—has the potential to multiply in value with successful exploration results.

The long-term outlook is equally convincing: gold continues to gain demand in uncertain times, and Quimbaya Gold has what it takes to become one of the winners of this trend. The combination of a record gold price, top-tier projects, and an undervalued company makes this stock an indispensable addition to any portfolio. Don’t hesitate — the opportunity is NOW! Buy Quimbaya Gold (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) before the price goes through the roof.

Conclusion: All the Ingredients for Success Are in Place

QUIMBAYA GOLD (CSE:QIM / OTC: QIMGF / WKN: A3DT3C) HIGHLIGHTS

- Direct neighbor of Aris Mining (TSX: ARIS), Colombia’s leading gold producer.

- Management holds ~37% of all shares, with 33.5% owned by the CEO — a very high insider ratio and strong vote of confidence. Both the CEO and CFO have recently increased their holdings.

- Another project located northeast of Collective Mining (TSX: CNL), one of the top exploration success stories in recent years (+375% in 2 years).

- Dr. Stewart Redwood, instrumental in the discovery of Aris Mining’s Marmato Gold Mine, is now part of the Quimbaya Gold team.

- VP of Exploration Ricardo Sierra previously worked for Continental Gold, acquired by Zijin Mining in 2020 for around USD 1.4 billion.

- Strong management team with extensive local experience (CEO has over 10 years in Colombia).

- High cash balance following successful financing rounds.

- Low current valuation, with only ~15 million shares in free float.

- Phase 1 drilling at Tahami: Adjacent to Aris Mining’s operating multi-million-ounce gold mine.

Fully funded 4,000-metre drill program just announced — to be paid entirely in shares, preserving cash.

References:

- Goldman Sachs

- World Gold Council: Riding a wave of uncertainty

- World Gold Council: Gold’s Next Move – ETFs, China & Investor Sentiment

- Canadian Insider

- Ahead of the Curve

- Quimbaya Gold: Tahimi

- Quimbaya Gold

- Quimbaya Gold: Independence Drilling

- Collective Mining

- Aris Mining

Disclaimer

Copyright 2025 © Goldmarketrecap.com is owned and operated by Connect 4 Marketing, a Quebec Corporation. For more information, please contact [email protected] This is NOT an official website of Questrade, Interactive Broker, TD Ameritrade, Fidelity, Charles Schwab or Ortbiton Financial but the official website of goldmarketrecap.com.

To more fully understand any subscription, website, application, product, or other service (“Services”) including stocksbychatgpt.com, owned or operated by Connect 4 Marketing (together with its affiliates, owners, and control persons, the “Publisher”), please carefully read the disclosure below.

This is an issuer-paid advertisement. Quimbaya Gold Inc. has paid Publisher CAD $100,000+HST in cash for marketing services, including communicating information about the Company to the Public and paid advertising budget. This advertorial (“advertisement” or “Advertorial”) is part of those issuer-paid marketing services. The contract with Quimbaya Gold Inc. was effective on February 17, 2025 and continues until February 28, 2025 OR when advertising budget is exhausted (the “Term”), unless terminated by written notice of either party prior to the end of the Term or extended. As a result of this advertisement and other marketing efforts, Publisher may also collect email addresses from readers that it may be able to monetize. As of the date of this advertisement, Publisher holds no securities of the Company and does not intend to purchase any securities during the Term. This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of the Company, increased trading volume, and possibly an increased share price, which may or may not be temporary and could decrease once the marketing services have ended.

We expect to receive additional compensation as the investor awareness continues. We will disclose every amount we receive. We own shares in (QIM). This compensation is a major conflict of interest in our ability to be unbiased regarding. Therefore, this communication should be viewed as a commercial advertisement only.

We have not investigated the background of the hiring party. The third party, profiled company, or their affiliates likely wish to liquidate shares of the profiled company at or near the time you receive this communication, which has the potential to hurt share prices. Any non-compensated alerts are purely for the purpose of expanding our database for the benefit of our future financially compensated investor relations efforts. Frequently companies profiled in our alerts may experience a large increase in volume and share price during the course of investor relations marketing, which may end as soon as the investor relations marketing ceases. Our emails may contain forward-looking statements, which are not guaranteed to materialize due to a variety of factors.

We do not guarantee the timeliness, accuracy, or completeness of the information on our site or in our newsletters. The information in our email newsletters and on our website is believed to be accurate and correct, but has not been independently verified and is not guaranteed to be correct. The information is collected from public sources, such as the profiled company’s website and press releases, but is not researched or verified in any way whatsoever to ensure the publicly available information is correct. Furthermore, Connect 4 Marketing Ltd. often employs independent contractor writers who may make errors when researching information and preparing these communications regarding profiled companies. Independent writers’ works are double-checked and verified before publication, but it is certainly possible for errors or omissions to take place during editing of independent contractor writer’s communications regarding the profiled company(s). You should assume all information in all of our communications is incorrect until you personally verify the information, and again are encouraged to never invest based on the information contained in our written communications. The information in our disclaimers is subject to change at any time without notice. Please invest carefully and read investment information available at the website of the SEC at http://www.sec.gov.

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY

Not Investment AdviceThis advertisement is for educational and informational purposes only. All material information contained in this advertisement is based on information generally available to the public, which public information is believed to be reliable and accurate. Nevertheless, Publisher cannot guarantee the accuracy or completeness of the information. This advertisement does not purport to be a complete analysis of this Company or any company’s financial position. This advertisement or any statements made in it are not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular individual. The statements made in this advertisement should NOT be relied upon for purposes of investing in the Company that is the subject of the Advertorial or any other companies mentioned in this Advertorial, nor should they be construed as a personalized recommendation to buy, sell, or hold any position in any security mentioned in this Advertorial or any other security or strategy. It is strongly recommended that you consult a licensed or registered professional before making any investment decision.

SUBSTANTIAL RISK INVOLVED

Any individual who chooses to invest in the securities of the Company profiled in the Advertorial or any securities of the companies mentioned in this advertisement should do so with caution. Although this advertisement focuses on the positive features of the Company profiled and its securities, you must keep in mind that investing or transacting in these or any securities involves substantial risk; you may lose some, all, or possibly more than your original investment. Readers of this advertisement bear responsibility for their own investment research and decisions and should use information from this advertisement only as a starting point for doing additional independent research to allow individuals to form their own opinion regarding investments. It is easy to lose money investing or trading, and we recommend always seeking individual advice from a licensed or registered professional and educating yourself as much as possible before considering any investments.

Not an Investment Advisor or Registered BrokerNeither Publisher nor any of their owners, employees, or independent contractors is currently registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization.USE OF FORWARD-LOOKING STATEMENTSCertain statements made in this advertisement may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act of 1934. Forward-looking statements often include words such as “believes,” “anticipates,” “estimates,” “expects,” “projects,” “intends,” or other similar expressions of future performance or conduct. Forward-looking statements are based on expectations, estimates, and projections at the time the statements are made and are not statements of historical fact. They involve many risks and uncertainties that could cause actual results or events to differ materially from those presently anticipated. There is no guarantee that past performance will be indicative of future results. Publisher does not undertake an obligation to update forward-looking statements in light of new information or future events.

TRADEMARKS

All trademarks used in this advertisement are the property of their respective trademark holders, and no endorsement by such owners of the contents of the advertisement is made or implied.

Connect 4 Marketing Ltd. and their affiliates and control persons (the “Publisher”) are in the business of publishing favorable information and/or advertisements (the “Information”) about the securities of publicly traded companies (each an “Issuer” or collectively the “Issuers”) in exchange for compensation (the “Campaigns”). Persons receiving the Information are referred to as the “Recipients.” The person or entity paying the Publisher for the Campaign is referred to herein as the “Paying Party.” The Paying Party may be an Issuer, an affiliated or non-affiliate shareholder of an Issuer, or another person hired by the Issuer or an affiliate or non-affiliate shareholder of the Issuer. The nature and amount of compensation paid to the Publisher for the Campaign and creating and/or publishing the Information about each Issuer is set forth below under the heading captioned, “Compensation.”

This website provides information about the stock market and other investments. This website does not provide investment advice and should not be used as a replacement for investment advice from a qualified professional. This website is for informational purposes only. The Author of this website is not a registered investment advisor and does not offer investment advice. You, the reader, bear responsibility for your own investment decisions and should seek the advice of a qualified securities professional before making any investment.

Nothing on this website should be considered personalized financial advice. Any investments recommended herein should be made only after consulting with your personal investment advisor and only after performing your own research and due diligence, including reviewing the prospectus or financial statements of the issuer of any security.

Connect 4 Marketing Ltd., its managers, employees, affiliates, and assigns (collectively the “Publisher”) do not make any guarantee or warranty about the advice provided on this website or what is otherwise advertised above.

To the maximum extent permitted by law, the Company disclaims all liability in the event any information, commentary, analysis, opinions, advice, and/or recommendations provided herein prove to be inaccurate, incomplete, or unreliable, or result in any investment or other losses.

Always do your own research and consult with a licensed investment professional before investing. This communication is never to be used as the basis for making investment decisions and is for entertainment purposes only. At most, this communication should serve only as a starting point to do your own research and consult with a licensed professional regarding the companies profiled and discussed. Conduct your own research.